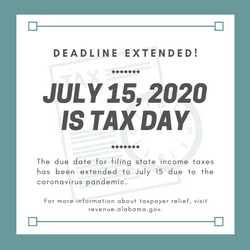

On April 10, 2020, the Alabama Department of Revenue announced that they have updated certain tax-relief policies as it relates to income and other taxes. Mirroring the expansion of filing and payments due-dates covered in a similar update issued by the IRS on April 9, the deadline for filing and payment of 2019 Alabama tax returns has been extended from April 15 to July 15, 2020.

"Taxpayers can defer state income tax payments due on or after April 1, 2020 (previously April 15), and before July 15, 2020, to July 15, 2020, without penalties and interest, regardless of the amount owed. This deferment applies to all taxpayers, including individuals, trusts and estates, corporations and other non-corporate tax filers.

Other taxes included in the deadline extension are corporate income tax, the Financial Institution Excise Tax (FIET), and the Business Privilege Tax (BPT).

Taxpayers do not need to file any additional forms or call the Alabama Department of Revenue to qualify for this automatic state tax filing and payment relief. Individual taxpayers who need additional time to file beyond the July 15 deadline can request a filing extension through the usual methods."

Add Comment